In order to provide equal access and equal opportunity to people with diverse abilities, this site has been designed with accessibility in mind. Click here to view

Oklahoma Legislature Sends Comprehensive Tax Cuts and Modernization Plan to Governor

OKLAHOMA CITY — The Oklahoma Legislature has passed a landmark tax reform measure that reduces the personal income tax and streamlines the state’s tax code. The bill now heads to Governor Kevin Stitt’s desk for final approval.

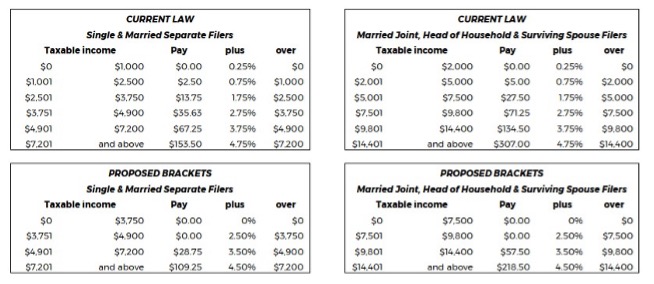

According to the provisions of House Bill 2764, beginning in tax year 2026, there will be a reduction of the top marginal personal income tax rate from 4.75% to 4.5% and it restructures the current six income tax brackets into three on taxable income.

In addition to these immediate changes, House Bill 2764 includes a forward-looking trigger mechanism that could phase out the personal income tax entirely, reducing the rate by 0.25% increments when revenue benchmarks are met, as certified by the State Board of Equalization.

The bill also includes strong safeguards: if a revenue failure is declared, any pending reduction is automatically canceled to protect core government services.

Senate President Pro Tempore Lonnie Paxton, R-Tuttle, praised the passage of House Bill 2764 as a smart, responsible step toward long-term tax reform.

“This tax modernization plan represents common-sense changes that help level the playing field for all Oklahomans,” Pro Tem Paxton said. “By simplifying our tax code and providing a pathway to lower taxes, we're making our state more competitive and attractive for businesses and families alike. Oklahoma has long been committed to fiscal responsibility, and this legislation allows us to continue that tradition while also creating a long-term vision for phasing out the personal income tax in a sustainable way. The trigger mechanism ensures that tax relief is tied to real revenue growth, not guesswork or gimmicks, and that we protect vital services even as we work to return more money to taxpayers. I appreciate our House colleagues for their work and for the governor’s input on this plan.”

House Speaker Kyle Hilbert, R-Bristow, called the bill a major win for taxpayers and the future of Oklahoma’s economy:

“This legislation is the result of thoughtful collaboration and a shared vision for Oklahoma's future,” Speaker Hilbert said. “By reducing the tax burden and streamlining our tax system, we're fostering an environment that encourages growth and prosperity for all citizens. House Bill 2764 is more than just a tax cut. It's a comprehensive plan that rewards economic growth, simplifies the tax process, and puts Oklahoma on a path to long-term competitiveness. We’ve built in conservative guardrails to ensure these cuts are fiscally responsible, while giving our economy the freedom to grow. I'm proud of the House and Senate for coming together to get this done for the people of Oklahoma.”

Breakdown of House Bill 2764

- Immediate Tax Relief: Reduces the top marginal personal income tax rate from 4.75% to 4.5% starting in tax year 2026.

- Simplified Tax Brackets: Consolidates six personal income tax brackets into three brackets on taxable income for easier understanding and administration.

- Automatic Reduction Triggers: Ties future tax rate reductions to state revenue performance, allowing for 0.25% cuts if certified benchmarks are met.

- Fiscal Safeguards: Nullifies any scheduled reduction if a revenue failure is declared, ensuring the state can continue to meet essential funding needs.

New Tax Bracket Structure (Effective Tax Year 2026)

Path to Full Income Tax Repeal – Trigger Framework

- Trigger Mechanism: Beginning in 2026, a 0.25% rate cut will be triggered when the comparison year’s total collections exceed the base year’s total collections by an amount equal to the cost of a 0.25% rate cut multiplied by 1.25.

- Certified by BOE: The State Board of Equalization will certify fiscal benchmarks annually in December.

- Delayed Effective Date: Any triggered cut takes effect in two tax years, providing ample time for budget adjustments.

- Revenue Failure Provision: If a revenue failure is declared in the intervening time, the scheduled cut is automatically nullified.

###

Oklahoma Senate

Oklahoma Senate